Depreciation of Manufacturing Equipment

IRS Publication 946 explains how you can use depreciation to recover the cost of business or income-producing property. It is calculated in equal annual increments over the useful life of the equipment.

Depreciation On Equipment Definition Calculation Examples

If a company uses a predetermined overhead rate actual.

. 71 rows For custom built or constructed equipment or facilities depreciation calculation begins one month after the item is put into service. 7The following entry would be used to record depreciation on manufacturing equipment. Wages of production workers Product Asset Advertising costs GSA Expense Promotion costs GSA.

Depreciation on manufacturing equipment. This problem has been solved. Assuming a retailer distributor or service provider does not manufacture goods.

Depreciation is the annual deduction allowed to recover the cost or other basis of business or investment property having a useful life substantially beyond the tax year. In other words the depreciation on the manufacturing facilities and. When an item is disposed of depreciation is taken.

We would like to show you a description here but the site wont allow us. Wages of production workers. Dun Bradstreet gathers Manufacturing business information from trusted sources to help you understand company performance growth potential and competitive pressures.

42221312 INDUSTRIAL MACHINERY AND EQUIPMENT DEPRECIATION SCHEDULE REPEALED See the Transfer and Repeal Table History. Studypool Inc Tutoring Mountain View CA. Depreciation is the reduction in the value of an asset year over year.

The table specifies asset lives for property subject to depreciation under the general depreciation system provided in section 168a of the IRC or the alternative depreciation system provided in. To calculate depreciation you must. Depreciation of Manufacturing Assets.

Studypool Inc Tutoring Mountain View CA Showing Page. For heavy use industries some equipment can depreciate in as quickly as three years while other equipment such as storage tanks may have a depreciation of 50 years. Manta has 16 businesses under Industrial Machinery in North Brunswick NJ.

Manufacturing Equipment Depreciation Calculation.

Accumulated Depreciation Overview How It Works Example

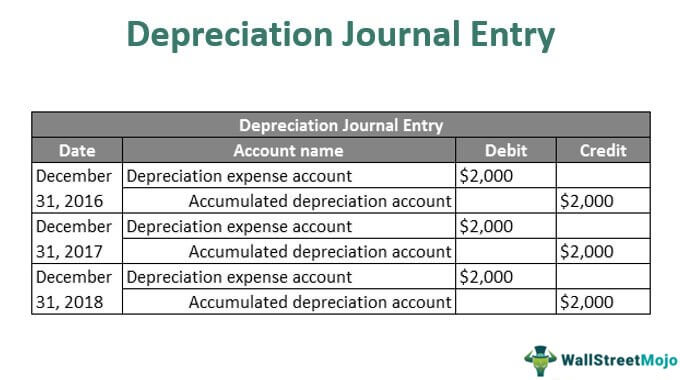

Depreciation Journal Entry Step By Step Examples

Accumulated Depreciation Explained Bench Accounting

Unit Of Production Depreciation Method Formula Examples

Depreciation Formula Calculate Depreciation Expense

:max_bytes(150000):strip_icc()/straight-line-depreciation-method-357598-Final-5c890976c9e77c00010c22d2.png)

0 Response to "Depreciation of Manufacturing Equipment"

Post a Comment